Here's why forcing the lowering of the Fed interest rates is a very bad idea right now

And a brief explanation of how inflation influences almost everything in our economy

📌 For daily updates, tips and musings, be sure to follow me on Instagram.

Despite trump claiming "we have no inflation" over and over again, the fact remains that we still do. The annual inflation rate was 2.4% in May, an uptick from a 2.3% annual rate in April.

The tariffs, no matter what % they are increased--and they have been increased across the board-- are inflationary. They are taxes on American goods, and our American businesses—mostly small & medium-sized businesses—will have to increase their pricing and pass those costs onto us in order to stay afloat.

Don’t forget that some corporations will increase their pricing even if they don't have to if demand is still there (we saw this during the pandemic and after supply chain issues were remedied.)

Tax cuts for the top 1% of high-income households and corporations are inflationary. Trickle down economics (the idea that if the wealthy business owners and corporations profit more, they’ll have more to share with their employees and customers) does not work, and it's been tested and proven over and over again in the U.S.

We can see this demonstrated with the Tax Cuts & Jobs Act of 2017 that trump enacted:

Households in the top 1% of income received the largest tax cuts in dollar terms, averaging over $60k in 2025.

The corporate tax rate cut from 35% to 21% largely benefited high-income shareholders and executives, rather than average workers.

Research shows that workers earning below a certain threshold saw no change in their earnings from the corporate tax cut....meaning, the profits did not trickle down at all.

While low- and middle-income Americans did experience some tax cuts, particularly through the doubled standard deduction and increased Child Tax Credit, these benefits were modest in comparison to the gains of the wealthy.

When coupled with potential spending cuts in social programs, low-income Households could even see a net financial loss from the overall changes.

Billionaire wealth has more than doubled, increasing by over $3.1 trillion since the 2017 tax law.

The 10 wealthiest Americans have seen their wealth grow even faster, increasing by an astounding 153% in just over six years.

These increases in wealth concentration at the top of the U.S. over the past several years is unprecedented (except for the Gilded Age).

Now we have the One Big Beautiful Bill Act (OBBB) that aims to extend and increase tax cuts for the wealthy to the tune of $2.4 trillion, in addition to cutting more social programs like Medicaid, a foundational bedrock to our society.

When the government spends money on things that do not put our resources to good use, like tax cuts for the rich, the deficit becomes extremely inflationary because:

It increases demand (more money in wealthiest hands) without increasing supply (output) like like infrastructure, education, or job training. Inflation happens when demand increases but supply doesn’t.

Tax cuts for the rich often don’t stimulate new production — the wealthy tend to save more or invest in assets, which can inflate bubbles (e.g. stock market, housing).

This is what Modern Monetary Theory (my latest obsession) strives to achieve: A deficit is not automatically inflationary. But if it's used on non-productive uses, like broad tax cuts with no return, and the economy is already at full capacity, then yes: it will be very inflationary.

When the government spends money on redistributing real resources, i.e. investing in infrastructure improvements, job creation, healthcare & climate resiliency, the economy improves for everyone, like:

bringing children out of poverty

providing life-saving healthcare

bringing us out of inequality levels last seen during the Gilded Age

and giving our Earth a chance to survive and reverse climate change

The idea of taxing the rich (the opposite of what this bill will do) isn’t about raising money for the government and paying down our debt. It’s about redistributing real resources so we don’t end up with a (continued) BROligarchy that can buy the presidency for $250MM and put a manchild wannabe dictator in the White House.

Now, If trump forces the Fed's hands or fires the Chair in order to lower interest rates before the economic signs indicates a green light, we are at risk of an extreme and prolonged inflationary period in the U.S., especially when you tie in the aspects of the OBBB being ushered in.

Why does lowering interest rates cause inflation?

Interest rates are the cost of borrowing…

When interest rates are lowered, it becomes cheaper to borrow money, i.e. buy a new house or car or start a new business, and then more people & businesses go into debt and spend more money.

Then an increase in demand of consumer spending results in price increases because businesses can charge more for their goods and services.

"But Danielle, that will stimulate the economy!" Yes, my darlings, but when inflation happens, our purchasing power is eroded…

Then we reduce our spending…

and then when companies experience higher costs (due to increasing costs for raw materials, labor and other operational expenses due to inflation)…

Companies face profit margin pressure that can cause layoffs…

and they reduce their investments, stifling expansion plans.

If you are thinking, “This all sounds just like one big vicious cycle!” you are somewhat correct…which is why it's so important to control inflation via a "soft landing" strategy and to manage the government spending in a way that benefits everyone--raising all levels of income and prosperity.

Inflation in and of itself isn’t the villain. Inflation is normal and a sign of an expansive economy, but the rate at which it increases is paramount. It can throw everyone off their balance if it's increasing too much, too fast. It must grow at stable, slow levels AND wages must also grow at stable, slow and fair levels in order for the tide to raise all…especially when an economy is already at capacity, like it is now (we just hit a new s&p 500 52-week high today.)

So again, forcing interest rates lower, combined with the OBBB that is packed with inflationary policies, is a recipe for disaster.

If you Google the causes of The Great Depression, albeit a complex economic event, you'll see multiple eerily similar contributing factors, such as:

The Stock Market Crash of 1929 - we had a swift recovery from "Liberation Day," but is our next crash right around the corner from these potential inflationary moves (and bubbles), war, tariffs and global divestment from America?

Banking panics - money runs are one area that we fixed with the FDIC, but it's still as only as good as our government's word and our social contracts. Money runs aside, 2008 wasn’t that long ago, was it? It’s plausible to think our banking system can crumble again. Are there some bubbles hiding around the corner?

Monetary Contraction – if you recall after the Financial Crisis of 2008, the Fed instituted 0% interest rates as a solution to encourage spending. It was an extreme reaction to an extreme recession—one that likely was influenced by the lack of action during the Great Depression. But it should only be reserved for dire situations, and most people forget that the low interest rates we had in the following 11-12 years was abnormal and a direct target at stimulating a recovering, deflated economy.

Right now, despite conflicting data and despite the actions of this administration, our economy continues to grow and expand (again, bubble alert, perhaps?) So one should naturally come to the conclusion that now is not the time to stimulate spending in the name of short-term S&P 500 gains.The Smoot-Hawley Tariff Act (1930) - high tariffs on imports leading to retaliatory tariffs from other countries and a decline in international trade. Sound familiar?

Declines in consumer spending - this will happen if interest rates are lowered too soon and too rapidly.

The Dust Bowl - we are not short of looming environmental disasters, especially with the de-funding of FEMA.

Income Equality - Inequality today stands at levels last seen during the Gilded Age, which was even worse that the 1920's and early 1930s.

So, what can be done now, realistically, to prevent an economic catastrophe?

Let the Fed do what they do best: decipher economic research and data, compare and contrast pros and cons of lowering interest rates, control or temper inflation and try to land the “soft landing” for our economy. Do not fire the Fed Chair!

The Senate should either vote down or amend the OBBB to take out spending cuts to our social programs, especially Medicaid and SNAP benefits. Either decrease the tax cuts for the wealthy or increase tax cuts for the lower- and middle- class through more programs like the Child Tax Credit and/or increase the federal minimum wage so families who are struggling the most could help to make up for the cuts to their social programs (if those are inevitable at this point).

trump should abandon all tariff wars and concede to minimal amounts with each country so businesses can adjust to nominally cost increases and move on. Stop using tariffs as some strong man tool to wield power.

trump should also stand by his previous word and not start a war. We cannot un-bomb Iran’s nuclear sites, but he should move forward in diplomacy. This “peace through strength” BS must end.

Lastly, they should pull back on the kidnapping-like deportations, stop these masked and unmarked sycophants living out their racist fetishes and reinstate respectable deportations of criminals with due process. ICE is tearing apart families, communities and businesses. Even saying that is an understatement, I know. The inhumanity is disgusting and abhorrent. But also, anyone who thinks there won’t be significant economic and environmental repercussions is living in a looney tune dream world.

This list is in no way a complete list of what can and should be done (if I had a magic wand, I’d need a whole separate article to explain my dream scenario), but it is restrained to what is possible within this regime, and even so, I know it’s a verrrrry long shot.

How long do we think Trump will put up with Powell before using extraordinary means to oust him? Given his manchild temperament, probably not long.

Perhaps Powell will eventually give in to him and tell himself this it’s just one dishonorable action for the sake of staying in power lest someone much more loyal to trump gets that position? I hope not. He only has one more year left of his term, but every day he stays there is a good thing.

We shall see.

Until then, we stay alert and we make money moves while the dominoes are still standing.

Here are some things you can do to prepare your money and finances before the dominoes begin to fall. These are the main principles I’m sticking with:

Cash is king

Reduce high-interest debt

Consider uncorrelated assets to traditional investments

Diversify even more & hedge, hedge, hedge by thinking about putting a chip on each square in this reality roulette game

Don’t stop investing altogether

Would love to hear your thoughts. What is concerning you the most these days when it comes to your money?

Hopefully

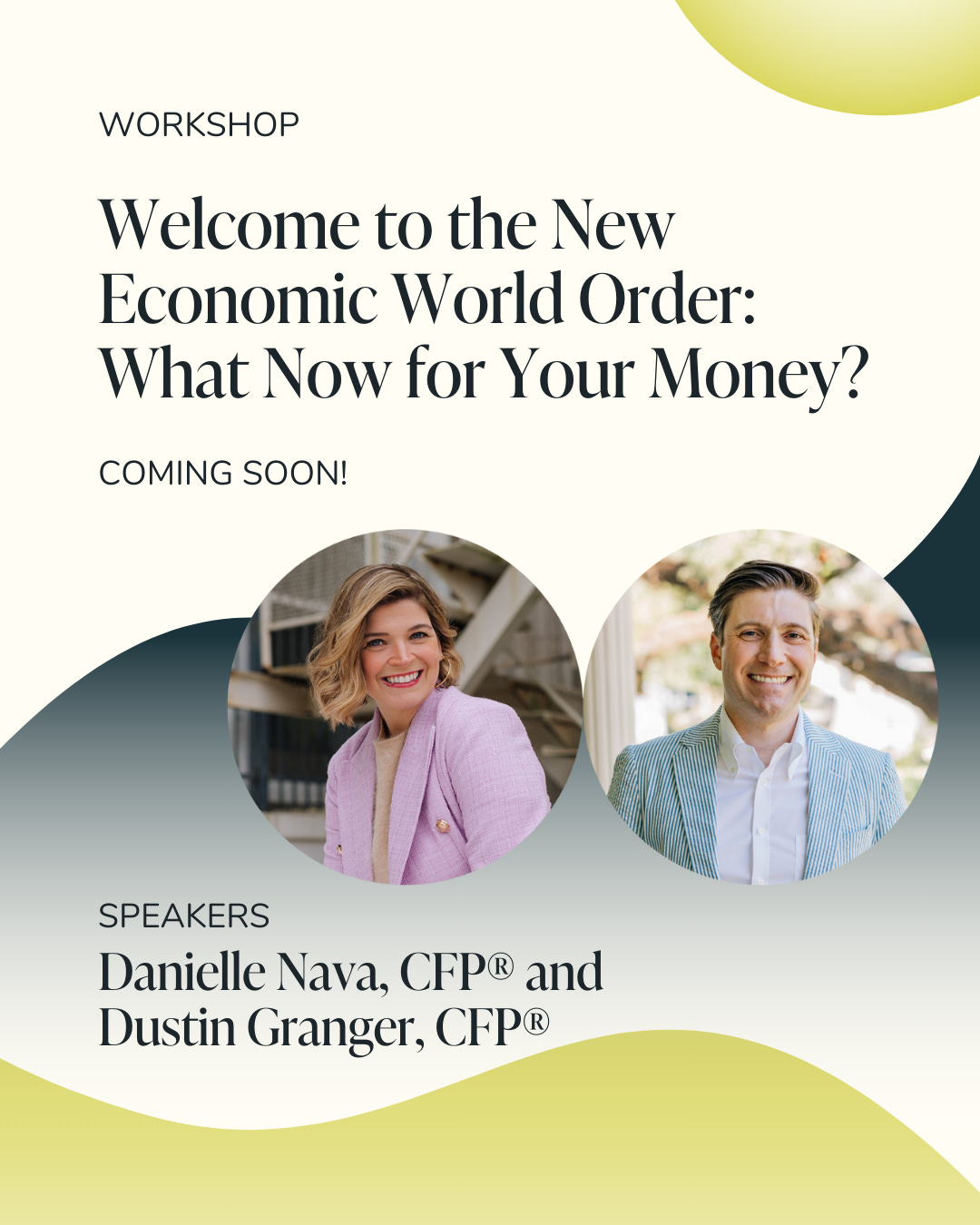

and I can continue our weekly WTH Happened This Week live videos in a week or two, when he arrives home from vacation and gets settled.And lastly, don’t forget to sign up to get updates on our upcoming webinar, Welcome to the new economic world order: what now for your money?

Til next time!

Danielle

Disclosure: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All investing involves risk including loss of principal. No strategy assures success or protects against loss.

Wow! This is an amazing read and explanation. It is like an Economy 101 primer for those who want to understand but don’t have the time or inclination to dig through the usual noise. Thanks for sharing it, especially sharing for free.

Appreciated your article. Cash is king. How do we protect it? Our dollar does not seem safe especially when it keeps devaluing. Safe havens like Treasuries do not seem as secure. I agree with Fed Chair Powell. How are we to know that economic data is accurate? How can the Fed make a decision on interest rates with everything constantly in flux?